The purpose of this article is to discuss the faulty logic that was used for determining commercial property values when Monroe County went through its reassessment in 2018.

When determining a property's value, we are considering how much a property would be worth if was sold. Appraisals are performed by banks and assessments by taxing authorities, but the two sets of numbers should be similar.

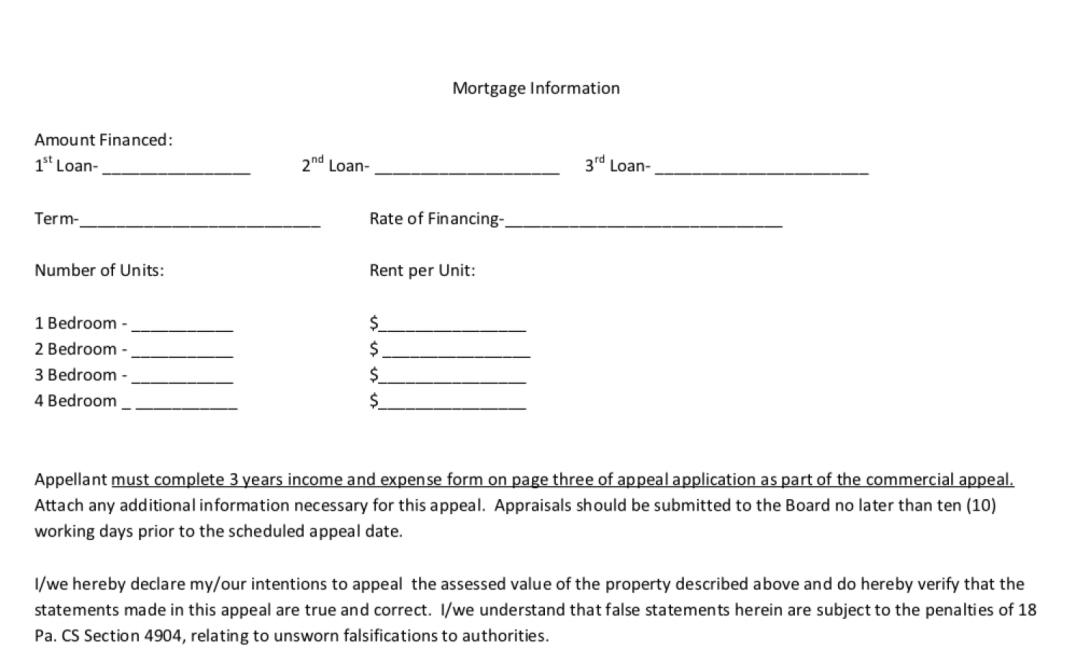

On page 2 of the appeal form, Monroe County asks:

A. how much the owner is charges for renting each unit.

B. how much much was financed, the term, and rate.

C. It also asks for 3 years of income and expenses.

(!!!?!?)

On page 3, it asks for more details that are irrelevant to the value of that property: 3 years of expenses for insurance, electricity, water, manager's salary, legal & accounting, advertising, and more.

The information requested: amount financed, the rents collected, and 3 years of expenses should be considered private, confidential, and therefore out of bounds when considering a property's value.

How do any of the following scenarios affect the property's value?

If a building owner:

- financed half of the property in the form of a commercial mortgage?

- decided to rent out his units at half price?

- pays more than he should for building maintenance?

- rents the units to Section 8 tenants where the rent is fixed?

If you think about it, I think you will agree that none of these items affect the property's VALUE - this is just another example of government overreach.