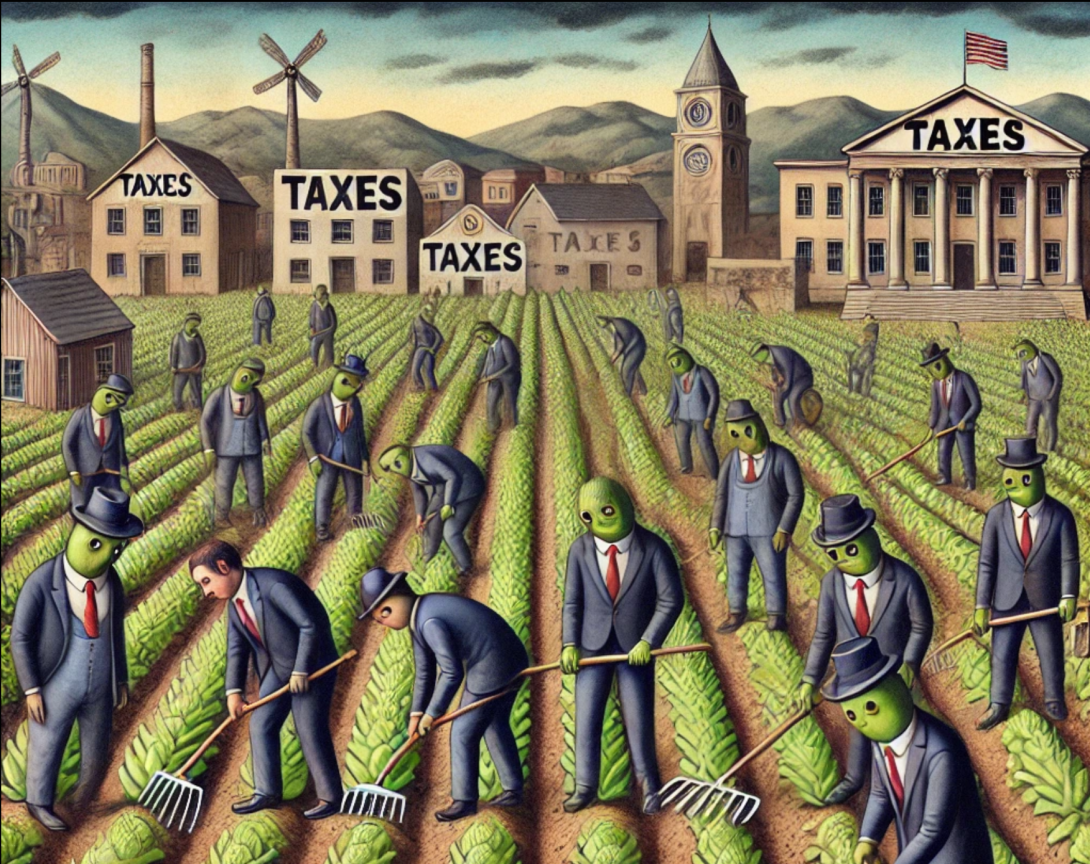

East Stroudsburg residents are voicing their frustration after the Borough Council approved a 29% property tax hike at their December 17, 2024, meeting. Concerned citizens argue that the council has failed to explore viable alternatives before placing the financial burden squarely on the shoulders of taxpayers.

Lack of Alternatives or Due Diligence

Residents allege that the council made no meaningful attempt to reduce costs or generate revenue by other means. Despite billions of dollars in tax-exempt properties in the borough—including for-profit hospitals, East Stroudsburg University, and vacant corporate buildings—the council has not pursued legal action to reassess these entities' tax status. Similar lawsuits in Pennsylvania have proven successful, with courts ruling that some so-called "nonprofit" entities were actually operating for profit and should contribute their fair share of property taxes.

Additionally, the council has ignored legislative solutions. Pennsylvania House Bill 451 proposes a Tax-Exempt Property Municipal Assistance Fund, funded by the state's 18% liquor tax, which could offset the tax burden for municipalities with significant tax-exempt properties. Yet, no effort was made to delay the tax hike until this bill progresses.

A History of Tax Increases

This latest increase follows a 15% hike last year, totaling an almost 50% rise in property taxes over two years. Critics fear the trend will continue, with some pointing to Fifth Ward Councilwoman Jane Gagliardo’s remarks suggesting she’d prefer an even steeper hike now to avoid addressing the issue again next year.

Constitutional Concerns

Beyond financial frustrations, residents argue the council's actions may be unconstitutional. The Fourteenth Amendment and the Pennsylvania Constitution guarantee protections for "life, liberty, or property," and residents assert that their property rights are being violated. Legal experts have noted the potential for a class-action lawsuit under federal statute 42 U.S.C. §1983, which provides recourse for government violations of constitutional rights.

Financial Mismanagement Allegations

Concerns extend to the borough’s financial oversight, with allegations of mismanagement and missing funds. According to residents, over $500,000 is unaccounted for, raising questions about the council's stewardship of taxpayer dollars.

Calls for Accountability

In light of these issues, many residents are demanding the resignation of council members, the Borough Manager, and the Mayor. "The residents are not private banks that can be robbed each time the council has a knee-jerk reaction," one concerned citizen said.

As the borough moves forward with its 2025 budget, residents are left wondering: When will the council address the root causes of financial strain instead of passing the buck to taxpayers?